It is a very common mistake when the January arrives that we get the date wrong. How often in the past two weeks have we stop ourselves as we write 2019 instead of 2020 in the date. When we are entering transactions into our accounting software it is very easy to get the date wrong as well. It happens all of the time.

The best way to stop this from happening is to use the period close options in your software. This will prevent you from accidently entering your transaction as January 2021 instead of January 2022. It will not stop you from entering December 2021 transactions as December 2022 but software systems usually give you a warning about this. So how do you close off a period?

Xero

To close off a period in Xero you will need Advisor level access. You then select Accounting, Advances and Financial Settings. Once you are in this section you have the option to Lock Dates. Pick a date that is practical, and remember there are two options – one for all users and one that still allows Advisors to make changes. I suggest you fill in both sections.

MYOB

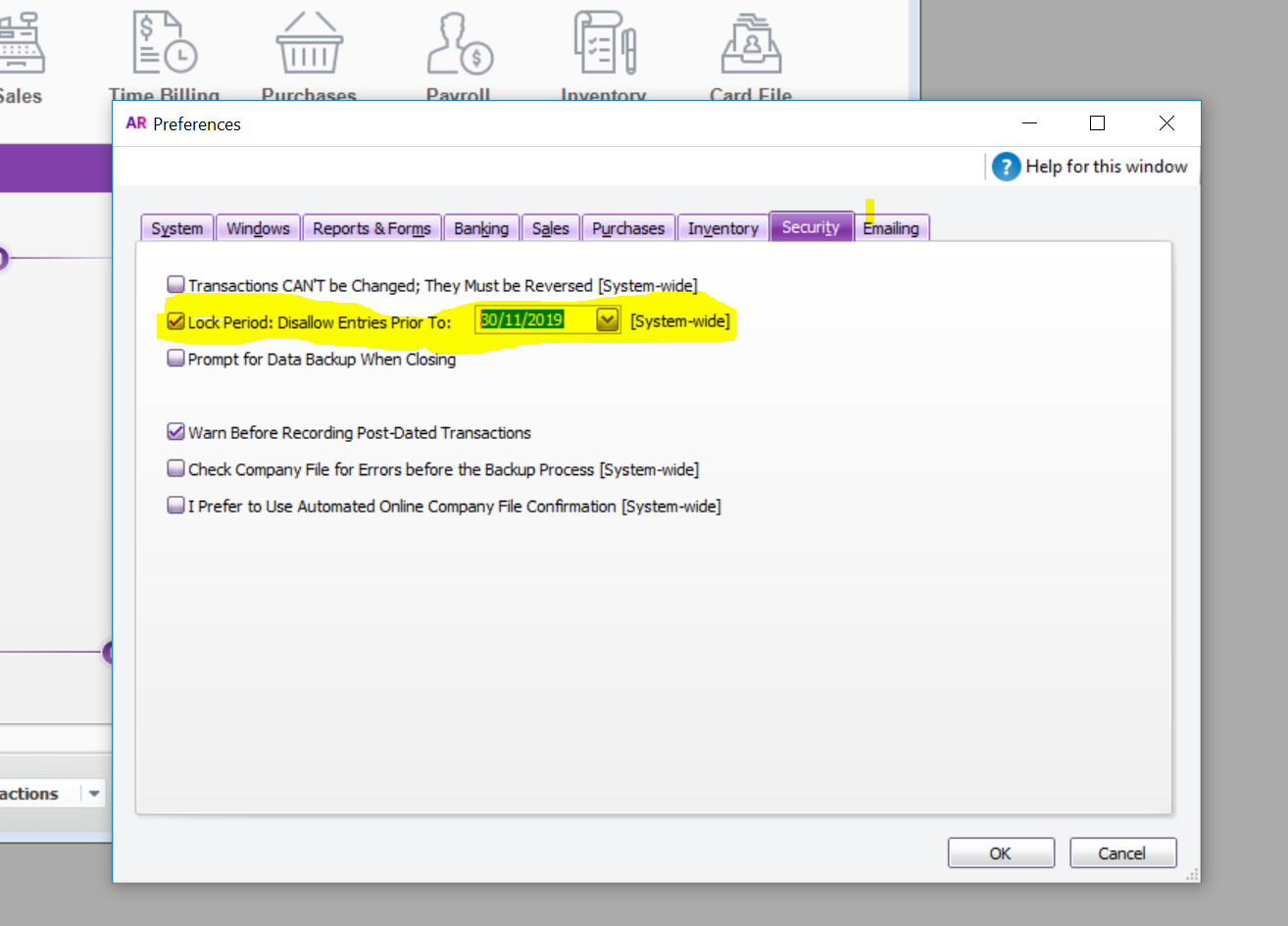

To close a period in MYOB choose Setup along the top of the MYOB program. Then choose Preferences and pick the Security tab. This gives you to option to Lock Period.

QBO

If you are using QBO you will need to go to the Setting icon in the top corner, of the screen. Choose Accounts and Settings, and then pick the Advanced Tab.

These changes will not prevent you from entering future dated transactions, so keep your eye out in your accounts for these. There is a future dated report you can run in MYOB but the other programs don’t have future dated reports.

Closing off a finalised period is a great habit to get into, particuarly once a BAS has been lodged or your accountant has finalised your accounts. Hopefully you will find this little tip handy as we grapple with getting the date correct in this new year.